According to CryptoPotato, Stacks, a Bitcoin Layer 2 solution, has experienced major growth over the last year, with a 3,386% quarterly and 3,028% annual increase in its revenue, reaching $637,000. The market capitalization of Stack's native cryptocurrency, STX, surged by 203% quarterly and an impressive 598% year-over-year, reaching a milestone of $2 billion.

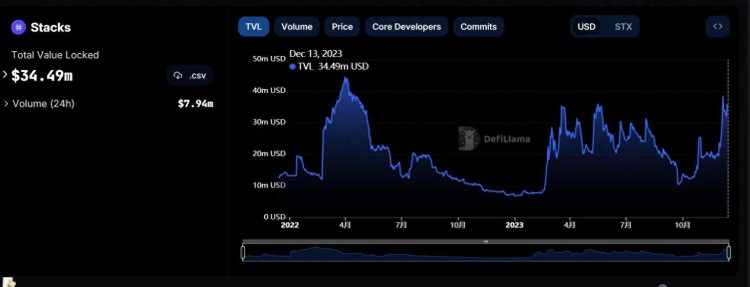

Messari's 'State of Stacks Q4 2023' report revealed a 363% quarterly increase in total value locked (TVL), translating to a 773% rise on an annual basis, reaching $61 million. The report also indicates a remarkable yearly increase in average daily miner revenue by 1,015%, reaching $78,000. Stacks' prominent position within the Bitcoin Layer-2 ecosystem and its prospects for further growth are highlighted, with the Nakamoto upgrade scheduled for April 2024 promising significant advancements.

The financial trajectory of Stacks has been propelled by the STX20 Inscription protocol, surpassing the growth metrics of both Bitcoin and the broader cryptocurrency market. Platforms such as ALEX, Arkadiko, and StackingDAO have contributed to Stacks' DeFi ecosystem, with a 52% quarterly rise in daily transactions and a 65% increase in active addresses. This heightened activity has led to a 400% quarter-over-quarter increase in average transaction fees (measured in STX) and an 894% increase when measured in USD, although the average transaction fee in USD terms remained relatively low at $0.25.

In 2024, projects developed on the Bitcoin network are being touted by various industry insiders as a prominent theme within the crypto sector. Nansen, an on-chain analysis company, has identified this trend as one of its four 'high-conviction bets' for the year, while Hashdex, a Brazilian asset management firm, has highlighted the emergence of the 'industrial era of Bitcoin' as a key development to watch.

![如何提高比特币序数? Stacks [STX] 价格](/images/20231229/7205022667815060003-1.jpg)